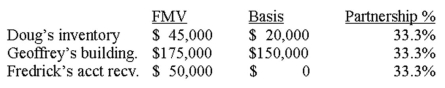

Doug,Geoffrey,and Fredrick form a partnership and contribute the following assets:  Geoffrey's building has a mortgage of $135,000 which the partnership assumes.

Geoffrey's building has a mortgage of $135,000 which the partnership assumes.

a.Do any of the partners recognize any gain? If so,how much and why?

b.What is each partner's basis in his or her partnership interest?

c.What is the basis to the partnership in each asset?

d.What are the holding periods to the partnership for each asset?

e.How would your answer change with respect to Geoffrey if his basis in the building was $85,000?

Definitions:

Bailee

A person or entity temporarily in possession of property entrusted to them by the owner under a bailment agreement.

Car Wash

A facility or service where vehicles are cleaned and detailed, either manually or through an automated process.

Liability

The state of being legally responsible for something, especially in terms of debts or legal obligations.

Stolen Jewelry

Property in the form of jewelry that has been taken without permission or legal right.

Q17: The general rule regarding income and expense

Q26: The basis of accounting that should be

Q33: What is meant by a penalty on

Q58: Due to a company consolidation,Rob transfers from

Q66: Matt and Opal were married in April

Q72: Which of the following is not a

Q77: Len is entitled to receive monthly payments

Q94: Angie earned $120,000 during 2014.She is single,claims

Q107: Which of the following statements is incorrect?<br>A)

Q115: With a Roth IRA,contributions are deductible,the account