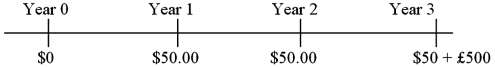

Find the value of a three-year dual currency bond with annual coupons (paid in U.S. dollars at a 5 percent coupon rate) that pays £500 per $1,000 par value at maturity. The cash flows of the bond are:  The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is π$ = 2% in the U.S. and π£ = 3% in the U.K.

The dollar-based yield to maturity is i$ = 3%; the spot exchange rate is $1.80 = £1.00; expected inflation over the next three years is π$ = 2% in the U.S. and π£ = 3% in the U.K.

Definitions:

Q2: A liquid stock market<br>A)is one in which

Q4: A U.S. firm holds an asset in

Q8: A convertible bond pays interest annually at

Q13: The underlying principle of the current/noncurrent method

Q30: The current exchange rate is €1.00 =

Q34: Find the present value of a 2-year

Q39: The credit rating of an international borrower<br>A)depends

Q40: Calculate the euro-based return an Italian investor

Q59: Translation exposure refers to<br>A)accounting exposure.<br>B)the effect that

Q61: Find the foreign currency gain or loss