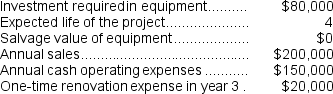

Lennox Corporation has provided the following information concerning a capital budgeting project: The company's tax rate is 35%.The company's after-tax discount rate is 8%.The project would require an investment of $20,000 at the beginning of the project.This working capital would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.

The company's tax rate is 35%.The company's after-tax discount rate is 8%.The project would require an investment of $20,000 at the beginning of the project.This working capital would be released for use elsewhere at the end of the project.The company uses straight-line depreciation on all equipment.

The total cash flow net of income taxes in year 2 is:

Definitions:

Familiarity

Close acquaintance with or knowledge of something.

Familiarity Criterion

A standard whereby something is judged or evaluated based on how well known or recognized it is.

Comparative Reasoning

A method of thinking or analysis that involves comparing different entities, ideas, or scenarios to understand their similarities, differences, and implications.

Pattern Recognition

The ability to identify and understand regularities or trends in data, symbols, words, or sounds.

Q9: Assume that Bharu is manufacturing and selling

Q11: The amount of depreciation added to net

Q20: Marbry Corporation's balance sheet and income statement

Q57: Rapozo Corporation has provided the following information

Q62: (Ignore income taxes in this problem.)Nevland Corporation

Q65: When used in return on investment (ROI)calculations,turnover

Q66: The total cash flow net of income

Q78: Cash equivalents on the statement of cash

Q121: Mcelveen Corporation has provided the following information

Q284: M.K.Berry is the managing director of CE