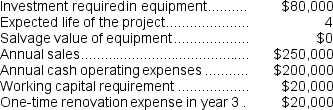

(Appendix 13C) Mulford Corporation has provided the following information concerning a capital budgeting project:

The company's income tax rate is 30% and its after-tax discount rate is 12%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

The company's income tax rate is 30% and its after-tax discount rate is 12%. The working capital would be required immediately and would be released for use elsewhere at the end of the project. The company uses straight-line depreciation on all equipment. Assume cash flows occur at the end of the year except for the initial investments. The company takes income taxes into account in its capital budgeting.

-The income tax expense in year 2 is:

Definitions:

Union Security Clauses

Provisions in a labor contract that require employees to join, maintain membership in, or pay dues to a union as a condition of employment.

Closed Shop

A form of union security agreement wherein only members of the union can be hired, and employees must remain members of the union to retain their jobs.

Union Member

is an individual who has formally joined a labor union, a collective organization that represents the interests of workers in negotiations with employers.

Safety Standards

Regulations and practices designed to ensure the physical safety of workers and prevent workplace accidents or injuries.

Q2: The net cash provided by (used in)financing

Q4: The required rate of return is the

Q16: On the statement of cash flows,the sales

Q22: Tobia Corporation has provided the following financial

Q44: Chene Corporation has provided the following information

Q66: The markup over cost under the absorption

Q72: Mattix Corporation's balance sheet and income statement

Q75: Seamons Corporation has the following information available

Q142: Depreciation expense is not included in the

Q166: Bowen Company produces products P,Q,and R from