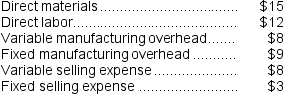

The Melville Corporation produces a single product called a Pong. Melville has the capacity to produce 60,000 Pongs each year. If Melville produces at capacity, the per unit costs to produce and sell one Pong are as follows:

The regular selling price for one Pong is $80. A special order has been received by Melville from Mowen Corporation to purchase 6,000 Pongs next year. If this special order is accepted, the variable selling expense will be reduced by 75%. However, Melville will have to purchase a specialized machine to engrave the Mowen name on each Pong in the special order. This machine will cost $9,000 and it will have no use after the special order is filled. The total fixed manufacturing overhead and selling expenses would be unaffected by this special order. Assume that direct labor is a variable cost.

The regular selling price for one Pong is $80. A special order has been received by Melville from Mowen Corporation to purchase 6,000 Pongs next year. If this special order is accepted, the variable selling expense will be reduced by 75%. However, Melville will have to purchase a specialized machine to engrave the Mowen name on each Pong in the special order. This machine will cost $9,000 and it will have no use after the special order is filled. The total fixed manufacturing overhead and selling expenses would be unaffected by this special order. Assume that direct labor is a variable cost.

-Assume Melville anticipates selling only 50,000 units of Pong to regular customers next year.If Mowen Corporation offers to buy the special order units at $65 per unit,the annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

Definitions:

Compounded Monthly

The process of calculating interest on both the initial principal and the accumulated interest of previous periods on a monthly basis.

Semi-Annually

A term referring to an event or action that occurs twice a year.

Quarterly

Occurring every three months or four times a year, often referring to financial reporting or dividend payments.

Increases in Value

Situations or circumstances where the value of an asset, investment, or property rises over time.

Q20: The total cash flow net of income

Q34: From a value-based pricing standpoint what range

Q49: (Ignore income taxes in this problem.)Ryner Corporation

Q52: Wamsley Products,Inc.,has a Transmitter Division that manufactures

Q56: Prosner Corp.manufactures three products from a common

Q78: The net present value of the project

Q116: Mike Corporation uses residual income to evaluate

Q139: Wolley Inc.reported the following results from last

Q144: Othman Inc.has a $800,000 investment opportunity with

Q189: WP Corporation produces products X,Y,and Z from