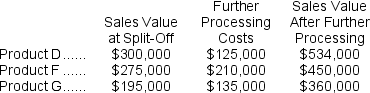

Prosner Corp.manufactures three products from a common input in a joint processing operation.Joint processing costs up to the split-off point total $500,000 per year.The company allocates these costs to the joint products on the basis of their total sales value at the split-off point.

Each product may be sold at the split-off point or processed further.The additional processing costs and sales value after further processing for each product (on an annual basis)are:

Required:

Required:

Which product or products should be sold at the split-off point,and which product or products should be processed further? Show computations.

Definitions:

Invest

Allocating resources, usually money, with the expectation of generating an income or profit.

Scrap Value

The estimated residual value of an asset after it has reached the end of its useful life, often associated with the material worth of its components.

Charge

A fee or cost for a service rendered or a penalty for a wrongdoing.

Voice-Activated

Technology that allows devices or software to be controlled through spoken commands, facilitating hands-free operation.

Q6: (Ignore income taxes in this problem.)Mattice Corporation

Q12: The present value of a given future

Q17: The net present value of Project B

Q47: Conaghan Avionics Corporation has developed a new

Q51: From a value-based pricing standpoint what is

Q62: Eady Wares is a division of a

Q85: Colantro Corporation has provided the following information

Q90: Suppose a company evaluates divisional performance using

Q108: Management is considering decreasing the price of

Q144: Othman Inc.has a $800,000 investment opportunity with