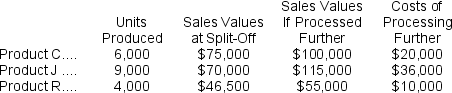

Benjamin Company produces products C,J,and R from a joint production process.Each product may be sold at the split-off point or processed further.Joint production costs of $95,000 per year are allocated to the products based on the relative number of units produced.Data for Benjamin's operations for last year follow:

Required:

Required:

Which products should be processed beyond the split-off point?

Definitions:

Federal Minimum Hourly

The lowest hourly wage that an employer can legally pay their employees, as mandated by federal law.

Wage Rate

The standardized amount of money paid for labor or services per unit of time (such as an hour or a month) or per unit of output.

Secondary Labor Market

A labor market segment characterized by lower pay, less job security, and fewer benefits compared to the primary labor market.

Employment Discrimination

Unfair treatment of employees based on race, gender, age, religion, nationality, disability, or sexual orientation, rather than job performance or qualifications.

Q5: (Ignore income taxes in this problem.)How much

Q14: Cabebe Corporation manufactures numerous products,one of which

Q19: The Clipper Corporation had net operating income

Q23: The income tax expense in year 2

Q57: (Ignore income taxes in this problem.)Charlie Corporation

Q59: If the discount rate is 10%,the net

Q81: The net present value of the entire

Q84: CoolAir Corporation manufactures portable window air conditioners.CoolAir

Q117: Ariel Corporation has provided the following information

Q118: Maurer Corporation is considering a capital budgeting