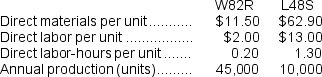

Werger Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHs).The company has two products,W82R and L48S,about which it has provided the following data:

The company's estimated total manufacturing overhead for the year is $1,521,960 and the company's estimated total direct labor-hours for the year is 22,000.

The company's estimated total manufacturing overhead for the year is $1,521,960 and the company's estimated total direct labor-hours for the year is 22,000.

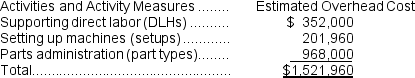

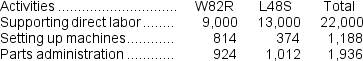

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports.Data for this proposed activity-based costing system appear below:

Required:

Required:

a.Determine the unit product cost of each of the company's two products under the traditional costing system.

b.Determine the unit product cost of each of the company's two products under activity-based costing system.

Definitions:

Modified AGI

Adjusted Gross Income adjusted by adding back certain deductions, often used to determine eligibility for various tax credits and retirement plans.

Qualified Adoption Expenses

Expenses that are necessary for and directly related to the legal adoption of an eligible child, which can include adoption fees, court costs, attorney fees, traveling expenses, and other expenses directly related to the adoption.

Child Tax Credit

A tax benefit in the United States designed to help families offset the cost of raising children by reducing their tax liability on a dollar-for-dollar basis.

AGI

An income calculation that includes all taxable income and is reduced by specific deductions, instrumental in determining tax obligations.

Q9: The manufacturing overhead that would be applied

Q12: The best way to avoid postsale problems

Q13: In the Excel,or spreadsheet,approach to recording financial

Q16: Which of the following would be classified

Q29: The predetermined overhead rate is closest to:<br>A)

Q45: What would be the total external failure

Q52: An employee time ticket is an hour-by-hour

Q55: What would be the total external failure

Q75: A direct cost is a cost that

Q103: Why are nonfinancial rewards important?