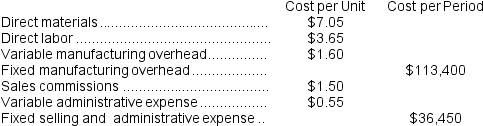

Dobosh Corporation has provided the following information:

Required:

Required:

a.For financial reporting purposes,what is the total amount of product costs incurred to make 9,000 units?

b.For financial reporting purposes,what is the total amount of period costs incurred to sell 9,000 units?

c.If 10,000 units are sold,what is the variable cost per unit sold?

d.If 10,000 units are sold,what is the total amount of variable costs related to the units sold?

e.If 10,000 units are produced,what is the total amount of manufacturing overhead cost incurred?

f.If the selling price is $21.60 per unit,what is the contribution margin per unit sold?

g.If 8,000 units are produced,what is the total amount of direct manufacturing cost incurred?

h.If 8,000 units are produced,what is the total amount of indirect manufacturing costs incurred?

i.What incremental manufacturing cost will the company incur if it increases production from 9,000 to 9,001 units?

Definitions:

Business Combinations

Occurs when one company acquires control over another, either through the purchase of shares, assets, or a merger.

Pooling of Interests

An accounting method used in business combinations that treats the entities as if they have been combined retroactively, distributing the equity shares among the combined entity's shareholders.

Purchase Method

An accounting method used to consolidate the financial statements of a parent company and its subsidiaries, reflecting the purchase of one entity by another.

Statutory Consolidation

The process of combining the financial statements of a group of companies into one, as required by law, to present the financial condition and operations of the group as a single entity.

Q7: Hiro sells building materials to local contractors.He

Q11: The overhead cost per unit of Product

Q11: Bridgette went to the Gap ready to

Q56: The predetermined overhead rate is closest to:<br>A)

Q88: Thomas had conducted a thorough pretest before

Q91: Sally could recall the brand of toothpaste

Q112: You are offered a sales position and

Q116: Because advertising is the most visible form

Q229: Mary Tappin,an assistant Vice President at Galaxy

Q263: Which of the following statements is correct