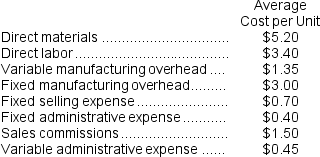

Parlavecchio Corporation's relevant range of activity is 2,000 units to 6,000 units.When it produces and sells 4,000 units,its average costs per unit are as follows:

Required:

Required:

a.For financial reporting purposes,what is the total amount of product costs incurred to make 4,000 units?

b.For financial reporting purposes,what is the total amount of period costs incurred to sell 4,000 units?

c.If 5,000 units are sold,what is the variable cost per unit sold?

d.If 5,000 units are sold,what is the total amount of variable costs related to the units sold?

e.If 5,000 units are produced,what is the average fixed manufacturing cost per unit produced?

f.If 5,000 units are produced,what is the total amount of fixed manufacturing cost incurred?

g.If 5,000 units are produced,what is the total amount of manufacturing overhead cost incurred? What is this total amount expressed on a per unit basis?

Definitions:

Net Debt

A financial metric calculated by subtracting a company's total cash and cash equivalents from its total short-term and long-term debt.

Government Organizations

Entities established by a government to carry out specific functions or services, operating within the public sector and funded by the government.

Accounting Standards

Rules and guidelines that prescribe the specific accounting methods and procedures to present financial statements accurately and consistently.

Investing Section

Part of a cash flow statement that shows the cash spent on and received from investment activities, indicating how a company is allocating its resources for growth.

Q9: Create a sales promotion to promote your

Q29: The sales process always proceeds through each

Q33: Bhakti was recently promoted to a sales

Q36: Which of the following would be classified

Q50: Once the marketing communication has captured the

Q65: Charming Charlie's,a fashion accessories retailer,encourages visitors to

Q84: If you are hired as a sales

Q86: Conversion cost equals product cost less direct

Q233: What would be the total variable inspection

Q281: If 3,000 units are produced,the total amount