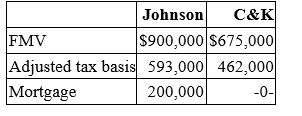

Johnson Inc. and C&K Company entered into an exchange of real property. Here is the information for the properties to be exchanged.  Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

Pursuant to the exchange, C&K paid $25,000 cash to Johnson and assumed the mortgage on the Johnson property. Compute C&K's gain recognized on the exchange and its tax basis in the property received from Johnson.

Definitions:

Goodwill Note

A written communication expressing gratitude, goodwill, or kindness, often used in professional settings to maintain positive relationships.

Good News

Information or updates that are positive, encouraging, or beneficial to the receiver.

Negative Impressions

The unfavorable opinions or feelings formed by individuals based on their interactions or experiences.

Reader's Confidence

The level of trust and belief a reader has in the credibility, accuracy, and reliability of the content they are reading.

Q1: Which of the following assets is not

Q20: Westside, Inc. owns 15% of Innsbrook's common

Q21: Mrs. Jansen is the sole shareholder of

Q26: Which of the following is not a

Q42: In its first taxable year, Platform, Inc.

Q64: According to the GAAP principle of conservatism,

Q64: Randolph Scott operates a business as a

Q66: Homer currently operates a successful S corporation.

Q85: A fire destroyed business equipment that was

Q90: Planning opportunities are created when the tax