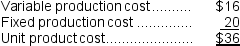

Sharp Corporation produces 8,000 parts each year, which are used in the production of one of its products.The unit product cost of a part is $36, computed as follows:  The parts can be purchased from an outside supplier for only $28 each.The space in which the parts are now produced would be idle and fixed production costs would be reduced by one-fourth.Based on these data, the financial advantage (disadvantage) of purchasing the parts from the outside supplier would be:

The parts can be purchased from an outside supplier for only $28 each.The space in which the parts are now produced would be idle and fixed production costs would be reduced by one-fourth.Based on these data, the financial advantage (disadvantage) of purchasing the parts from the outside supplier would be:

Definitions:

Profit-Maximizing Output

The point of production where a company reaches its maximum profit potential.

Short Run

A period in which at least one input (e.g., capital) is fixed, limiting the capacity for output adjustment.

Long-Run Cost Function

An economic model that describes how production costs change over time as all inputs can be varied by the producer.

Marginal Cost Function

A mathematical relationship describing how the cost of producing one additional unit of output varies as production scale changes.

Q17: Some investment projects require that a company

Q28: Anglen Co.manufactures and sells trophies for winners

Q39: The net operating income for Year 1

Q44: (Ignore income taxes in this problem.)Ramson Corporation

Q55: If management decides to buy part U98

Q76: Based solely on the information above, the

Q87: Brissett Corporation makes three products that use

Q87: Negative free cash flow suggests that the

Q91: Two-Rivers Inc.(TRI)manufactures a variety of consumer products.The

Q104: (Ignore income taxes in this problem.)Denny Corporation