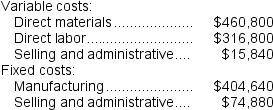

Anglen Co.manufactures and sells trophies for winners of athletic and other events.Its manufacturing plant has the capacity to produce 18,000 trophies each month; current monthly production is 14,400 trophies.The company normally charges $103 per trophy.Cost data for the current level of production are shown below:  The company has just received a special one-time order for 900 trophies at $48 each.For this particular order, no variable selling and administrative costs would be incurred.This order would also have no effect on fixed costs.Assume that direct labor is a variable cost.

The company has just received a special one-time order for 900 trophies at $48 each.For this particular order, no variable selling and administrative costs would be incurred.This order would also have no effect on fixed costs.Assume that direct labor is a variable cost.

Required:

Should the company accept this special order? Why?

Definitions:

Relevant Range

The range of activity within which the assumptions about fixed and variable cost behaviors hold true.

Variable Cost

Costs that vary directly with the level of production or service provision, such as materials, labor, and utilities consumed in the production process.

Total Variable Cost

The sum of all costs that vary directly with the level of production or output, including materials and labor.

Period Costs

Period costs are expenses that are not directly tied to the production process and are expensed in the period they are incurred, such as selling, general, and administrative expenses.

Q17: Evita Corporation prepares its statement of cash

Q23: Under the direct method of determining the

Q46: On the statement of cash flows, the

Q86: Moates Corporation has provided the following data

Q94: The required rate of return is the

Q95: If the discount rate is 10%, the

Q141: (Ignore income taxes in this problem.)Trovato Corporation

Q165: A manufacturing cycle efficiency (MCE)of less than

Q329: The spending variance for equipment depreciation for

Q458: Kerekes Manufacturing Corporation has prepared the following