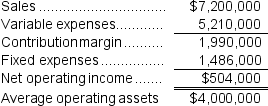

Wolley Inc.reported the following results from last year's operations:  At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

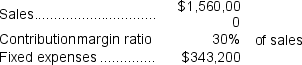

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:  The company's minimum required rate of return is 14%.

The company's minimum required rate of return is 14%.

Required:

1.What was last year's margin? (Round to the nearest 0.1%.)

2.What was last year's turnover? (Round to the nearest 0.01.)

3.What was last year's return on investment (ROI)? (Round to the nearest 0.1%.)

4.What is the margin related to this year's investment opportunity? (Round to the nearest 0.1%.)

5.What is the turnover related to this year's investment opportunity? (Round to the nearest 0.01.)

6.What is the ROI related to this year's investment opportunity? (Round to the nearest 0.1%.)

7.If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall margin this year? (Round to the nearest 0.1%.)

8.If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall turnover this year? (Round to the nearest 0.01.)

9.If the company pursues the investment opportunity and otherwise performs the same as last year, what will be the overall ROI will this year? (Round to the nearest 0.1%.)

10.If Westerville's chief executive officer earns a bonus only if the ROI for this year exceeds the ROI for last year, would the CEO pursue the investment opportunity? Would the owners of the company want the CEO to pursue the investment opportunity?

Definitions:

Algorithms

Step-by-step procedures or formulas for solving a problem or performing a task.

Trading of Stocks

The act of buying, selling, or exchanging shares of companies listed on a stock exchange with the aim of generating a profit.

Investments

Assets purchased with the goal of generating income or appreciating in value over time.

Amazon Business

A business marketplace on Amazon providing business-to-business transactions and features like bulk pricing and business accounts.

Q3: The labor efficiency variance for the month

Q55: If management decides to buy part U98

Q72: (Ignore income taxes in this problem.)Laws Corporation

Q97: Brookings Corporation is an oil well service

Q161: (Ignore income taxes in this problem.)Anthony operates

Q165: A manufacturing cycle efficiency (MCE)of less than

Q188: Gallerani Corporation has received a request for

Q206: Herlocker Corporation is a shipping container refurbishment

Q376: The spending variance for occupancy expenses in

Q443: Wytch Corporation bases its budgets on machine-hours.The