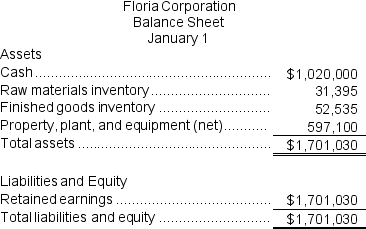

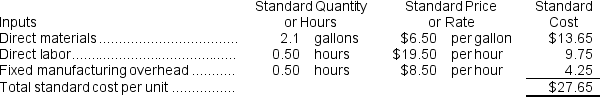

Floria Corporation manufactures one product.It does not maintain any beginning or ending Work in Process inventories.The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold.There is no variable manufacturing overhead.The company's balance sheet at the beginning of the year was as follows:  The standard cost card for the company's only product is as follows:

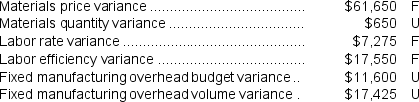

The standard cost card for the company's only product is as follows:  The company calculated the following variances for the year:

The company calculated the following variances for the year:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $148,750 and budgeted activity of 17,500 hours.

During the year, the company completed the following transactions:

a.Purchased 68,500 gallons of raw material at a price of $5.60 per gallon.

b.Used 64,990 gallons of the raw material to produce 30,900 units of work in process.

c.Assigned direct labor costs to work in process.The direct labor workers (who were paid in cash)worked 14,550 hours at an average cost of $19.00 per hour.

d.Applied fixed overhead to the 30,900 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed.Actual fixed overhead costs for the year were $160,350.Of this total, $78,350 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $82,000 related to depreciation of manufacturing equipment.

e.Transferred 30,900 units from work in process to finished goods.

f.Sold for cash 27,200 units to customers at a price of $33.50 per unit.

g.Completed and transferred the standard cost associated with the 27,200 units sold from finished goods to cost of goods sold.

h.Paid $79,000 of selling and administrative expenses.

i.Closed all standard cost variances to cost of goods sold.

Required:

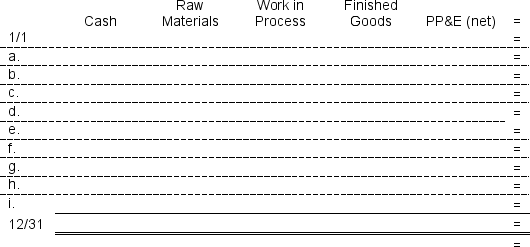

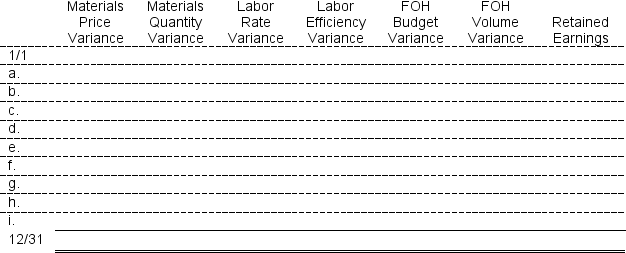

1.Enter the beginning balances and record the above transactions in the worksheet that appears below.Because of the width of the worksheet, it is in two parts.In your text, these two parts would be joined side-by-side to make one very wide worksheet.

2.Determine the ending balance (e.g., 12/31 balance)in each account.

Definitions:

Industry-versus-inferiority

A stage in Erik Erikson's theory of psychosocial development where children learn to be productive and develop skills or feel inferior for not meeting expectations.

Erik Erikson

Erik Erikson was a developmental psychologist known for his theory on psychosocial development, which outlines eight stages of human development across the lifespan.

Developmental Challenge

A task or situation that requires adaptation or growth in one or more areas of development, such as cognitive, physical, or social-emotional.

Easy Babies

Babies who have a positive disposition; their body functions operate regularly, and they are adaptable.

Q17: The wages and salaries in the planning

Q47: The budgeted direct labor cost per unit

Q62: Signore Corporation uses a standard cost system

Q106: When the direct labor cost is recorded,

Q122: The basic idea underlying responsibility accounting is

Q129: The variable overhead rate variance is:<br>A)$18,955 F<br>B)$19,125

Q200: The estimated direct labor cost for May

Q202: Laizure Clinic uses patient-visits as its measure

Q345: The variable overhead efficiency variance for February

Q413: The selling and administrative expenses in the