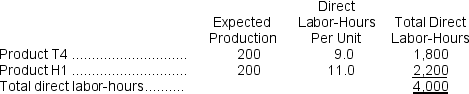

Steuart, Inc., manufactures and sells two products: Product T4 and Product H1.Data concerning the expected production of each product and the expected total direct labor-hours (DLHs)required to produce that output appear below:  The direct labor rate is $26.00 per DLH.The direct materials cost per unit for each product is given below:

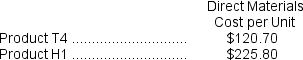

The direct labor rate is $26.00 per DLH.The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

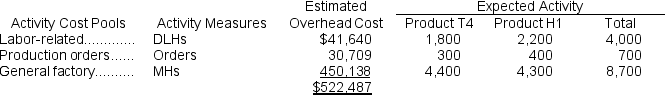

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Required:

What is the difference between the unit product costs under the traditional costing method and the activity-based costing system for each of the two products?

Definitions:

Senate

A legislative assembly in some countries, often part of a bicameral system, tasked with making and passing laws.

Presidential Election

A formal decision-making process by which a country's citizens choose an individual to hold the office of President.

Defamation

A false communication that harms another's reputation, which can be in written form (libel) or spoken form (slander).

Venue

(1) The place where a hearing takes place. Its geographic location is determined by each state’s statutes and based on where the parties live or where the event occurred or the alleged wrong was committed. (2) A legal doctrine relating to the selection of a court with subject-matter and personal jurisdiction that is the most appropriate geographic location for the resolution of the dispute.

Q23: Using the high-low method, the estimate of

Q46: Using the high-low method of analysis, the

Q53: The direct labor cost was:<br>A)$11,600<br>B)$19,900<br>C)$8,000<br>D)$11,000

Q117: The overhead applied to each unit of

Q146: The overhead cost per unit of Product

Q149: The unit product cost for Job K818

Q189: The amount of overhead applied in the

Q193: The cost of goods manufactured for May

Q208: The journal entry to record the allocation

Q217: Grib Corporation uses a predetermined overhead rate