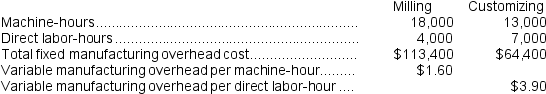

Comans Corporation has two production departments, Milling and Customizing. The company uses a job-order costing system and computes a predetermined overhead rate in each production department. The Milling Department's predetermined overhead rate is based on machine-hours and the Customizing Department's predetermined overhead rate is based on direct labor-hours. At the beginning of the current year, the company had made the following estimates:

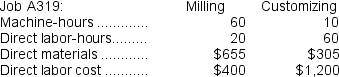

During the current month the company started and finished Job A319. The following data were recorded for this job:

During the current month the company started and finished Job A319. The following data were recorded for this job:

-The amount of overhead applied in the Customizing Department to Job A319 is closest to:

Definitions:

Joint Costs

The costs that are incurred from producing two or more products in the same process.

Split-Off

A point in the manufacturing process where joint products are separated and continue through the production process as distinct items.

Sales Margin

The difference between the selling price of a product and its cost of sales, usually represented as a percentage of sales.

Changing Technology

The rapid evolution and adoption of new techniques, tools, and software which can disrupt industries and alter business operations.

Q13: Which of the following variables would be

Q48: Assume that the company uses departmental predetermined

Q62: Dancel Corporation has two production departments, Milling

Q74: The amount of overhead applied to Job

Q84: Eppich Corporation has provided the following data

Q138: If 6,000 units are produced, the total

Q185: The total amount of overhead applied in

Q241: The total of the period costs listed

Q244: Mccaughan Corporation bases its predetermined overhead rate

Q256: In a job-order costing system, indirect labor