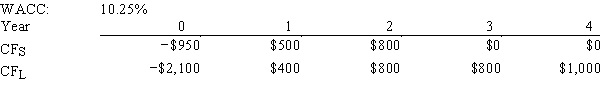

Yonan Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.If the decision is made by choosing the project with the shorter payback,some value may be forgone.How much value will be lost in this instance? Note that under some conditions choosing projects on the basis of the shorter payback will not cause value to be lost.

Definitions:

Probability of Nonpayment

The likelihood or risk that a borrower will not fulfill their payment obligations on a loan or debt.

Revenue

The total amount of money received by a company for goods sold or services provided during a specific period.

Cash Discount

An incentive offered by sellers to encourage buyers to pay earlier, resulting in a reduction in the amount due.

Captive Finance Company

A finance company that is wholly owned by a parent company, primarily for the purpose of providing financing to the customers of the parent company.

Q6: The federal government sometimes taxes dividends and

Q8: Kosovski Company is considering Projects S and

Q16: Which of the following statements is most

Q22: Which of the following statements is CORRECT?<br>A)One

Q25: Data for Dana Industries is shown below.Now

Q37: Other things held constant,the higher a firm's

Q52: A stock is expected to pay a

Q64: Teall Development Company hired you as a

Q83: Vang Enterprises,which is debt-free and finances only

Q95: Inmoo Company's average age of accounts receivable