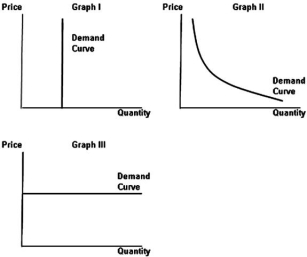

-If a sales tax is imposed on a product,which of the following statements is correct?

Definitions:

Cost Allocation

The distribution or assignment of indirect, common, or joint costs to different departments, processes, or products within an organization.

Step-Down Method

A cost allocation method used in accounting that allocates overhead costs to cost objects in a sequence, where each department allocates its costs to other departments based on a predetermined order.

Allocation Sequence

The order or process by which costs or resources are distributed among various departments or projects.

Q17: Refer to the above information to answer

Q19: June's evaluation of packets of nacho chips

Q19: What is total revenue?<br>A)It is the profits

Q30: Assume that the market for jeans is

Q52: What is the term for a market

Q69: What causes marginal cost to increase?<br>A)The advantages

Q72: Why might a good harvest be bad

Q102: Which of the following is a correct

Q108: Refer to the above information to answer

Q142: Distinguish between the substitution effect and substitute