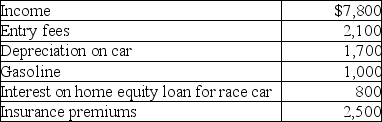

Kyle drives a race car in his spare time and on weekends.His records regarding this activity reflect the following information for the year.  What is the allowable deduction (before any AGI limitation) for depreciation assuming that this activity is not engaged in for profit and Kyle can itemize his deductions?

What is the allowable deduction (before any AGI limitation) for depreciation assuming that this activity is not engaged in for profit and Kyle can itemize his deductions?

Definitions:

Q35: Explain when educational expenses are deductible for

Q43: An accountant takes her client to a

Q52: Sarah purchased a new car at the

Q57: Brandon,a single taxpayer,had a loss of $48,000

Q66: During the current year,Donna,a single taxpayer,reports the

Q66: Homer Corporation's office building was destroyed by

Q75: Discuss when expenses are deductible under the

Q87: A business provides $45,000 of group-term life

Q108: Rob sells stock with a cost of

Q146: Capital recoveries increase the adjusted basis of