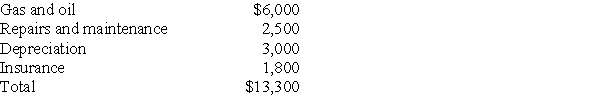

Sarah purchased a new car at the beginning of the year.She makes an adequate accounting to her employer and receives a $2,400 (12,000 miles × 20 cents per mile)reimbursement in 2017 for employment-related business miles.She incurs the following expenses related to both business and personal use:

She also spent $200 on parking and tolls that were related to business.During the year she drove a total 20,000 miles.

She also spent $200 on parking and tolls that were related to business.During the year she drove a total 20,000 miles.

What are the possible amounts of Sarah's deductible transportation expenses?

Definitions:

Self-Determination Theory

A theory of motivation that emphasizes the role of individuals' innate psychological needs in the development of personality and self-regulation.

Implicit Motives

Unconscious desires, aspirations, or needs that influence an individual's behavior and decision-making processes.

Explicit Motives

Directly expressed or stated goals and desires of an individual, often conscious and related to specific outcomes.

Meaning In Life

Refers to the significance, purpose, or value one finds in their existence or in specific aspects of their life.

Q19: The Tax Relief Act of 2001 provided

Q31: Mickey has a rare blood type and

Q52: Sarah purchased a new car at the

Q58: If you have current assets of $20,000

Q65: A high debt ratio indicates an excessive

Q66: An example of an opportunity cost is

Q106: Rajiv,a self-employed consultant,drove his auto 20,000 miles

Q114: Erin,a single taxpayer,has 1,000 shares of 1244

Q126: On August 1 of this year,Sharon,a cash-method

Q144: Liz,who is single,lives in a single family