The following transactions occurred in fiscal 2018:

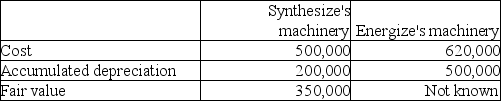

• Synthesize Inc.exchanged machinery with Energize Corp.

• Synthesize Inc.purchased equipment by signing a 5 year non-interest bearing note payable for $200,000.The implicit rate of interest was 5%.

• Synthesize received a government grant of $10,000 to help purchase the equipment.

Required:

a)Assuming the machinery exchange has commercial substance,prepare the required journal entries for the exchange for both Synthesize and Energize.

b)Assuming the machinery exchange does not have commercial substance,prepare the required journal entries for the exchange for both Synthesize and Energize.

c)Prepare the required journal entry to record the purchase of the equipment purchased by the non-interest bearing note.

d)Prepare the required journal entries to record the government grant using both the gross method and the net method.

Definitions:

Expected Monetary Values

A financial analysis method used to anticipate the potential financial results by assessing the varied possible outcomes and the likelihood of each occurring, considering their impact on overall financial performance.

Expected Value

The anticipated value of a variable, computed as an average of all possible values weighted by their probabilities.

Expected Monetary Value

A calculation used in decision-making to determine the average outcome when the future includes scenarios that may or may not happen.

Analytic Decision Making

The process of making choices by systematically analyzing information, evaluating alternatives, and basing decisions on rational evidence.

Q18: Daniel Manufacturing Limited (DML)purchased a large lathe.The

Q25: The following transactions occurred in fiscal 2018:<br>•

Q42: Company Ten purchased land for $400,000 during

Q42: Maximum Inc.reported credit sales of $880,000,bad debt

Q49: Assume that ending inventory in fiscal 2016

Q61: What should an investment in a debt

Q62: A particular production process requires two types

Q74: The following transactions occurred in fiscal 2018:<br>•

Q76: Explain why it is important to segregate

Q87: What is a "disposal group"?<br>A)A component of