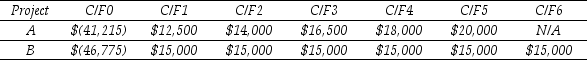

Use the table for the question(s)below.

Consider two mutually exclusive projects with the following cash flows:

-Assuming that the discount rate for project A is 16% and the discount rate for B is 15%,then given that these are mutually exclusive projects,which project would you take and why?

Definitions:

Student Stress Scale

A measurement tool designed to evaluate the amount and impact of stress experienced by students in the academic environment.

Life Changes

Significant transformations in a person's life that can affect their emotional or physical well-being.

Homeostasis

The tendency of a biological system to maintain stability while adjusting to conditions that are optimal for survival.

Interdisciplinary Subspecialty

A field that combines aspects from multiple disciplines to approach a particular issue or topic from various perspectives.

Q3: The enkephalins, along with <span

Q4: Which of the following coenzymes forms the

Q12: Wyatt Oil is contemplating issuing a 20-year

Q22: Amphetamine and mescaline are agonists of

Q26: Suppose you plan on purchasing Von Bora

Q29: If the risk-free rate of interest (r<sub>f</sub>)is

Q33: Which of the following statements regarding growing

Q35: The forward rate for year 3 (the

Q57: Epiphany is worried about the reliability of

Q61: The effective annual rate on your firm's