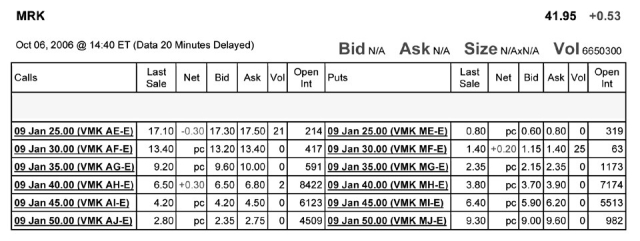

Use the table for the question(s) below.

Consider the following information on options from the CBOE for Merck:

-Assume it is now January of 2007 and the current risk-free interest rate is 1%.Using Put-Call Parity and the January 30 option (ask price) ,estimate the relative contribution of the near-term dividends to the value of Merck's stock.

Definitions:

Standard Machine-Hours

An accounting measure used to allocate manufacturing overhead costs to products based on the number of hours machines are expected to operate.

Variable Overhead Rate Variance

The difference between the expected (standard) cost of the variable overhead based on the actual production volume and the actual variable overhead incurred.

Standard Machine-Hours

A predetermined amount of time that a machine is expected to operate to meet production requirements.

Manufacturing Overhead

All indirect costs associated with the manufacturing process, including rent, utilities, and salaries for employees not directly involved in production.

Q7: Assume that to fund the investment Taggart

Q11: The free cash flow to equity in

Q15: Which of the following statements regarding sinking

Q36: The amount of net working capital for

Q38: Assuming that Ideko has a EBITDA multiple

Q38: The idea that claims in one's self-interest

Q64: The total debt overhang associated with accepting

Q66: Assume that capital markets are perfect except

Q79: Luther's return on equity (ROE)for the year

Q87: A(n)_ is the most common way that