Use the following information to answer the question(s) below.

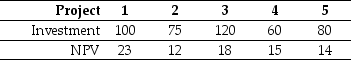

Nielson Motors has a debt-equity ratio of 1.8,an equity beta of 1.6,and a debt beta of 0.20.It is currently evaluating the following projects,none of which would change Nielson's volatility.  (All amounts are in $millions. )

(All amounts are in $millions. )

-The total debt overhang associated with accepting project 4 is closest to:

Definitions:

Semi-strong-form Efficient

Semi-strong-form efficiency is a class of market efficiency that posits that all public information is already reflected in stock prices, making it impossible to consistently achieve higher returns by trading on that information.

Historical Prices

The past trading prices of a security or commodity, often analyzed to identify trends and patterns for future trading decisions.

Variance

A statistical measure of the dispersion of data points in a data set around the mean, indicating the volatility and risk associated with a particular asset or investment.

Standard Deviation

A measure of the amount of variation or dispersion of a set of values, indicating how much the values in a data set differ from the mean of the data set.

Q4: Assuming that Ideko has a EBITDA multiple

Q8: The expected alpha for Wyatt Oil is

Q9: If Ideko's loans will have an interest

Q12: The effective dividend tax rate for a

Q14: If Flagstaff currently maintains a .5 debt

Q15: The variance on a portfolio that is

Q25: Following the borrowing of $12 million and

Q38: Assuming that Ideko has a EBITDA multiple

Q45: The amount of net working capital for

Q54: Calculate the effective tax disadvantage for retaining