Use the following information to answer the question(s) below.

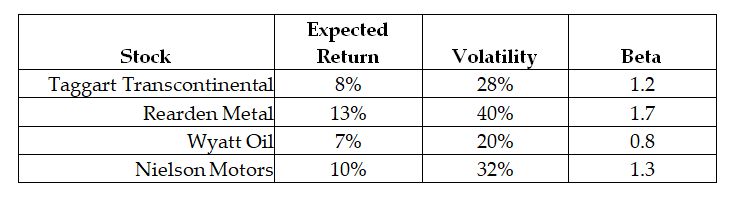

Assume that the CAPM is a good description of stock price returns. The market expected return is 8% with 12% volatility and the risk-free rate is 3%. New information arrives that does not change any of these numbers, but it does change the expected returns of the following stocks:

-The expected alpha for Taggart Transcontinental is closest to:

Definitions:

Emile Durkheim

A French sociologist, one of the founding figures of sociology, known for his studies on social cohesion, religion, and theories on the social causes of suicide.

Lower-Income People

Lower-income people are individuals or groups that earn significantly less money compared to the average income levels within a society.

Deviant Acts

Actions that go against the norms or laws of a society, which can range from minor nonconformities to major offenses.

Ritualists

Individuals who strictly adhere to established rituals or ceremonies, often within a religious or cultural context.

Q15: The variance on a portfolio that is

Q28: The weight on Lowes in your portfolio

Q39: Assume that investors hold Google stock in

Q47: How is the optimal portfolio choice affected

Q62: If the risk-free rate is 5% and

Q62: Which of the following agency problems represents

Q78: The effective dividend tax rate for a

Q83: Assuming your cost of capital is 6

Q88: In 2006,Luther Incorporated paid a special dividend

Q134: The variance on a portfolio that is