Use the information for the question(s) below.

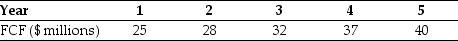

You expect CCM Corporation to generate the following free cash flows over the next five years:  Following year five,you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

Following year five,you estimate that CCM's free cash flows will grow at 5% per year and that CCM's weighted average cost of capital is 13%.

-The enterprise value of CCM corporation is closest to:

Definitions:

Fixed

Refers to an interest rate or investment that remains constant and does not fluctuate over a specified period.

Operating Leverage

This is a measure of how revenue growth translates into growth in operating income, showing the proportion of fixed costs in a company's cost structure.

Financial Leverage

Financial leverage refers to the use of borrowed funds to increase the potential return on investment, amplifying both potential gains and losses.

Technological Advantages

Benefits a company gains by utilizing superior technology compared to its competitors, potentially leading to higher efficiency and profit margins.

Q2: The required return for Sisyphean's new project

Q8: One of the reasons that it is

Q10: The depreciation tax shield for Shepard Industries

Q17: Most provinces in Canada have harmonized their

Q25: Suppose that you want to use the

Q26: The unlevered cost of capital for Anteater

Q41: The required return is _ that is

Q62: The forward rate for year 2 (the

Q63: Which stock has the highest systematic risk?<br>A)

Q81: Why does the yield to maturity of