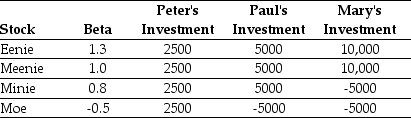

Use the table for the question(s)below.

Consider the following three individuals portfolios consisting of investments in four stocks:

-Explain how having different interest rates for borrowing and lending affects the CAPM and the SML.

Definitions:

Discrimination

The unjust or prejudicial treatment of different categories of people, often based on race, age, sex, or disability.

Prejudice

Preconceived opinion or bias, often negative, towards an individual or group without sufficient knowledge, thought, or reason.

Ambiguous

Describes something that can be understood in more than one way or has multiple possible interpretations, often leading to confusion or misunderstanding.

Oppression

A situation where a group is governed in a cruel or unjust manner, often suffering the restriction of their freedom, rights, or wellbeing.

Q3: California Gold Mining's beta with the market

Q33: The standard deviation for the return on

Q33: The valuation Triad links the firm's<br>A) expected

Q38: Which of the following statements is false?<br>A)

Q42: Which of the following statements is false?<br>A)

Q54: Which of the following statements is false?<br>A)

Q65: Which of the following statements is false?<br>A)

Q74: Independent risk is also called<br>A) market risk.<br>B)

Q79: The yield to maturity for the two

Q92: The correlation between Lowes' and Home Depot's