Use the information for the question(s)below.

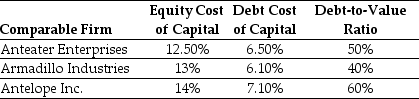

The Aardvark Corporation is considering launching a new product and is trying to determine an appropriate discount rate for evaluating this new product.Aardvark has identified the following information for three single division firms that offer products similar to the one Aardvark is interested in launching:

-Based upon the three comparable firms,calculate that most appropriate unlevered cost of capital for Aardvark to use on this new product.

Definitions:

Recommendations Section

A segment in a document or report that provides advice or suggests actions based on the analysis or findings presented.

Conclusions Section

The part of a document or presentation that summarizes the key findings, implications, and recommendations based on the discussed material.

Collected Data

Information that has been gathered through observation, experimentation, surveys, or other methodologies for analysis and decision-making.

Specific Actions

Detailed steps or measures to be taken in order to achieve a particular goal or resolve an issue.

Q14: The unlevered beta for Nod is closest

Q17: Which of the following statements is false?<br>A)

Q25: Suppose that you want to use the

Q31: The size effect reflects the fact that

Q40: Which of the following statements is false?<br>A)

Q43: Suppose that you want to use the

Q63: The effective dividend tax rate for a

Q67: Assume that MM's perfect capital markets conditions

Q70: Which of the following formulas is incorrect?<br>A)

Q84: Which of the following statements is false?<br>A)