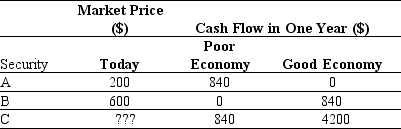

Use the table for the question(s) below.

-Suppose a risky security pays an average cash flow of $100 in one year.The risk-free rate is 5%,and the expected return on the market index is 13%.If the returns on this security are high when the economy is strong and low when the economy is weak,but the returns vary by only half as much as the market index,then the price for this risky security is closest to:

Definitions:

Integration

The process of combining or coordinating separate elements or groups to function together as a unified whole.

Adaptive Corporate Culture

Refers to an organizational culture that is flexible and responsive to changes in the external environment, encouraging innovation and learning.

Reactive

Responding to situations or stimuli after they have occurred, rather than anticipating or preventing them.

Reactive

A manner of responding to situations or stimuli after they have occurred, rather than anticipating or preventing potential issues.

Q6: If ECE's return on assets (ROA)is 12%

Q12: The IRR for this project is closest

Q15: On the balance sheet,current maturities of long-term

Q43: The internal rate of return (IRR)for project

Q71: Place point Z on the graph to

Q73: The present value (at age 30)of your

Q86: The NPV for this project is closest

Q233: Which statement is false?<br>A)Had the stock market

Q236: The three main crops of the nation

Q248: The federal government facilitated suburbanization by providing