Use the information for the question(s)below.

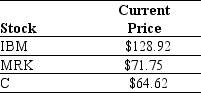

An exchange traded fund (ETF)is a security that represents a portfolio of individual stocks.Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM),three shares of Merck (MRK),and three shares of Citigroup Inc.(C).Suppose the current market price of each individual stock are shown below:

-The price per share of the ETF in a normal market is:

Definitions:

Autocrine

Relating to or denoting a mode of hormone action where a hormone affects the same cell type that produced it.

Nuclear Receptor

A class of proteins within cells that, upon binding with a ligand, can act as transcription factors to regulate gene expression.

G Protein

A type of protein that acts as a molecular switch inside cells, involved in transmitting signals from stimuli outside the cell to its interior.

Neural Inhibition

A process in the nervous system where certain neurons suppress the activity of other neurons, helping to control and refine neural circuits.

Q3: The price per share of this ETF

Q4: If a business is a large purchaser

Q11: Which of the following benefits with respect

Q20: The Principal-Agent Problem arises:<br>A)because managers have little

Q29: The maximum number of IRRs that could

Q31: Consider the following time line: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7031/.jpg"

Q32: Larry should:<br>A)reject the offer because the NPV

Q64: A 4-year default-free security with a face

Q81: The firm's revenues and expenses over a

Q82: The amount that the price of bond