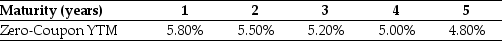

Use the table for the question(s) below.

Consider the following zero-coupon yields on default-free securities:

-The price today of a 3-year default-free security with a face value of $1000 and an annual coupon rate of 6% is closest to:

Definitions:

T-account

A graphical representation of a ledger account that outlines the effects of transactions on a specific account, used in double-entry bookkeeping.

Transactions

Financial interactions or exchanges between two or more parties, often involving the transfer of goods, services, or funds.

Investing Activity

Refers to buying and selling long-term assets and other investments, a key part of a company's cash flow statement.

Statement of Cash Flows

An overview presenting the collective cash revenues from a company’s operational efforts and external funding sources, together with all cash disbursements for corporate actions and investments, during a designated period.

Q27: The price you would be willing to

Q33: The expected return for Rearden Metal is

Q45: The cost of capital for a project

Q48: Rearden's expected dividend yield is closest to:<br>A)

Q57: Suppose that a security with a risk-free

Q62: Which of the following adjustments to net

Q69: If the current inflation rate is 5%,then

Q70: The yield to maturity for the three

Q86: If a stock pays dividends at the

Q117: Which of the following statements is false?<br>A)