Use the table for the question(s)below.

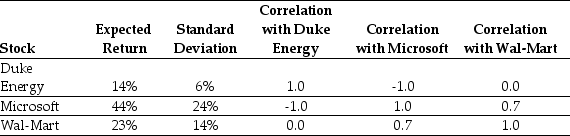

Consider the following expected returns,volatilities,and correlations:

-Consider a portfolio consisting of only Microsoft and Wal-Mart stock.Calculate the expected return on such a portfolio when the weight on Microsoft stock is 0%,25%,50%,75%,and 100%

Definitions:

Q8: Consider a portfolio consisting of only Duke

Q18: Which of the following statements is false?<br>A)

Q27: The price you would be willing to

Q43: The beta for Wyatt Oil is closest

Q44: In 2005,assuming an average dividend payout ratio

Q58: The value of Shepard Industries without leverage

Q60: Which of the following statements is false?<br>A)

Q66: Wyatt Oil's excess return for 2009 is

Q67: What is the excess return for the

Q69: The alpha for Chihuahua is closest to:<br>A)