Use the following information to answer the question(s) below.

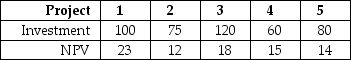

Nielson Motors has a debt-equity ratio of 1.8,an equity beta of 1.6,and a debt beta of 0.20.It is currently evaluating the following projects,none of which would change Nielson's volatility.  (All amounts are in $millions. )

(All amounts are in $millions. )

-Nielson Motors should accept those projects with profitability ratios greater than:

Definitions:

Homophobia

Fear of or discrimination toward gay, lesbian, and bisexual people.

Farmer

An individual engaged in agriculture, raising living organisms for food or raw materials.

Second Shift

Refers to the double burden of work and domestic responsibilities that many women face, where they complete their paid labor only to begin unpaid labor at home.

Sexual Orientation Identity

An individual's personal sense of their own sexual orientation, which can include categories such as heterosexual, homosexual, bisexual, asexual, etc.

Q5: Assume you want to buy one option

Q8: Which of the following statements is false?<br>A)

Q13: Assume that you are an investor with

Q18: Which of the following statements is false?<br>A)

Q22: Assume that EGI decides to wait until

Q30: If Wyatt Oil distributes the $70 million

Q41: Consider the following equation:<br>C = S -

Q69: The alpha for Chihuahua is closest to:<br>A)

Q88: The interest rate tax shield for Kroger

Q118: Explain how having different interest rates for