Use the information for the question(s) below.

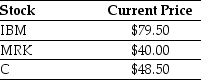

An exchange traded fund (ETF) is a security that represents a portfolio of individual stocks. Consider an ETF for which each share represents a portfolio of two shares of International Business Machines (IBM), three shares of Merck (MRK), and three shares of Citigroup Inc. (C). Suppose the current market price of each individual stock are shown below:

-Assume that the ETF is trading for $426.00.What (if any)arbitrage opportunity exists? What (if any)trades would you make?

Definitions:

Course of Dealing

A pattern of actions between parties that establishes a common basis for understanding in future transactions.

Usage of Trade

Established customs and practices in a particular industry that are considered binding or enforceable in business transactions.

Express Terms

Specific provisions or conditions explicitly stated in a contractual agreement.

Wholly Integrated

Completely and seamlessly combined or unified into a whole, leaving no element disconnected or separate.

Q2: Which of the following statements is correct?<br>A)

Q9: Consider an ETF that is made up

Q26: Canada Revenue Agency,CRA,allows an exemption from double

Q37: You are considering using the incremental IRR

Q46: Hammond Motors is considering using a public

Q59: The internal rate of return (IRR)for project

Q69: Consider the following timeline: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1623/.jpg" alt="Consider

Q72: Suppose that the ETF is trading for

Q72: Which of the following statements is false?<br>A)

Q78: Suppose that if GSI drops the price