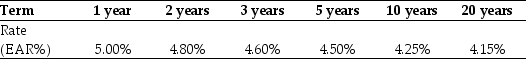

Use the table for the question(s) below.

Suppose the term structure of interest rates is shown below:

-The present value of receiving $1000 per year with certainty at the end of the next three years is closest to:

Definitions:

Consecutive Years

A period of time consisting of sequential years immediately following one another without interruption.

Predicting

The action or process of making forecasts about future events or outcomes based on current or historical data.

Weak Form

The hypothesis that past stock prices and trading volume do not affect future stock prices, suggesting that technical analysis cannot predict future movements.

Efficient-Market Hypothesis

The theory that all available information is already reflected in stock prices, suggesting that it is impossible to consistently achieve higher returns than the overall market through expert stock selection or market timing.

Q2: What type of company trades on an

Q11: If you take the $2,500 rebate and

Q30: Which of the following statements is FALSE?<br>A)

Q36: If we use future value rather than

Q39: Consider a bond that pays $1000 in

Q72: The amount that the price of bond

Q75: Which of these bonds sells at a

Q89: Which of the following statements is FALSE?<br>A)

Q93: Suppose that KAN's beta is 1.5.If the

Q106: Which of the following statements is FALSE?<br>A)