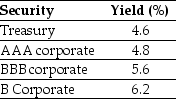

Use the table for the question(s) below.

Consider the following yields to maturity on various one-year zero-coupon securities:

-The credit spread of the B corporate bond is closest to:

Definitions:

Symmetrical

A shape or distribution that is mirrored and balanced on both sides of a central point.

Standard Normal Distribution

A type of normal distribution where the mean is 0 and the standard deviation is 1.

Mean

The arithmetic average of a set of numbers, calculated by adding up all the values and dividing by the count of numbers.

Variance

A statistical measure that determines the spread of numbers in a data set by calculating the mean of the squared differences from the mean.

Q17: Kinston Industries just announced that it will

Q18: Which of the following statements is FALSE?<br>A)

Q41: If you want to value a firm

Q55: If the discount rate for project B

Q61: Which of the following statements is FALSE?<br>A)

Q63: Which of the following statements is FALSE?<br>A)

Q84: The Sisyphean Company's common stock is currently

Q86: The percentage change in the price of

Q88: A 3 year default free security with

Q90: Consider a portfolio consisting of only Microsoft