Multiple Choice

Use the table for the question(s) below.

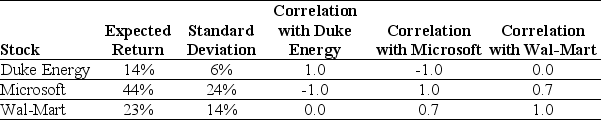

Consider the following expected returns, volatilities, and correlations:

-The volatility of a portfolio that is consists of a long position of $10000 in Wal-Mart and a short position of $2000 in Microsoft is closest to:

Explain the process of sugar transport from the mesophyll cells through the phloem.

Describe the pressure flow model of translocation and its dependence on pressure gradients.

Identify the role of active transport and osmosis in the transport of sugars and water.

Recognize the importance of Casparian strips in controlling water movement within roots.

Definitions:

Related Questions

Q9: The variance on a portfolio that is

Q37: Which of the following statements is correct?<br>A)

Q45: What is the efficient frontier and how

Q52: You currently own $100,000 worth of Wal-Mart

Q52: Assume that THSI's cost of capital for

Q58: You are considering using the incremental IRR

Q66: If in the event of distress,the present

Q79: Prior to any borrowing and share repurchase,RC's

Q99: Which of the following statements is FALSE?<br>A)

Q116: The Sharpe Ratio for the market portfolio