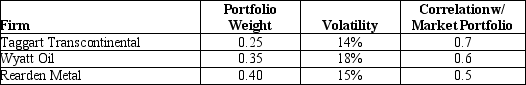

Use the following information to answer the question(s) below.  The volatility of the market portfolio is 10%,the expected return on the market is 12%,and the risk-free rate of interest is 4%.

The volatility of the market portfolio is 10%,the expected return on the market is 12%,and the risk-free rate of interest is 4%.

-The Sharpe Ratio for the market portfolio is closest to:

Definitions:

Direct Labor

The cost of wage-earning employees who are directly involved in the production of goods or services, such as assembly line workers.

Direct Labor Rate Variance

The difference between the actual cost of direct labor and the standard cost, demonstrating how actual labor costs differ from budgeted amounts.

Materials Price Variance

The difference between the actual cost of materials used in production and the standard cost, multiplied by the quantity of materials used.

Fixed Manufacturing Overhead

The portion of manufacturing overhead costs that do not vary with production volume, such as rent and salaries of supervisors.

Q25: Which of the following statements is FALSE?<br>A)

Q28: The price today of a three-year default-free

Q30: Assuming that your capital is constrained,which project

Q31: Which of the following statements is FALSE?<br>A)

Q42: Suppose that to raise the funds for

Q48: The variance on a portfolio that is

Q55: Which of the following formulas is INCORRECT?<br>A)

Q69: Assuming that in the event of default,20%

Q93: Taggart Transcontinental has issued at par a

Q96: If in the event of distress,the present