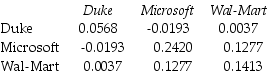

Use the table for the question(s)below.

Consider the following covariances between securities:

-The variance on a portfolio that is made up of a $6000 investments in Microsoft and a $4000 investment in Wal-Mart stock is closest to:

Definitions:

Nonbreaching Party

The party in a contractual agreement who has not violated the contract's terms.

Rights

Entitlements or permissions, either legally guaranteed or morally granted, to perform or not perform certain actions.

Contractual Obligations

Duties that parties are legally bound to perform under a contract.

Terminated

The condition of having been ended or concluded, often referring to employment, contracts, or services.

Q5: What is the variance on a portfolio

Q7: The NPV for Boulderado's snowboard project is

Q15: The level of incremental sales associated with

Q23: Taggart Transcontinental has a divided yield of

Q35: The NPV profile graphs:<br>A) the project's NPV

Q39: The amount of money that Galt's fund

Q39: The expected return of a portfolio that

Q62: Because debtor-in-possession (DIP)financing is senior to all

Q88: Which of the following statements is FALSE?<br>A)

Q115: Which of the following statements is FALSE?<br>A)