Use the following information to answer the question(s) below.

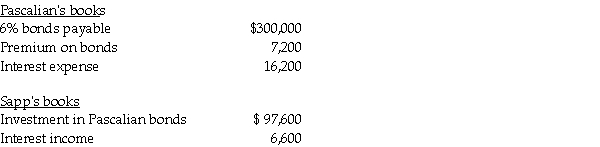

Pascalian Company owns a 90% interest in Sapp Company.On January 1,2010,Pascalian had $300,000,6% bonds outstanding with an unamortized premium of $9,000.The bonds mature on December 31,2014.Sapp acquired one-third of Pascalian's bonds in the open market for $97,000 on January 1,2010.Both companies use straight-line amortization of bond discounts/premiums.Interest is paid on December 31.On December 31,2010,the books of the two affiliates held the following balances:

-The gain from the bond purchase that appeared on the December 31,2010 consolidated income statement was

Definitions:

Labor Intensive

Describes production processes or industries that require a large amount of labor relative to capital to produce goods or services.

Fixed Asset Investments

Long-term investments in tangible assets such as property, plant, and equipment, intended for use in operations.

Trade-In Allowance

The value subtracted from the price of a new item when an old item is given as part of the deal.

Book Value

The net value of an asset or company calculated by total assets minus intangible assets (patents, goodwill) and liabilities.

Q10: A use tax is imposed by:<br>A)The Federal

Q17: For internal decision-making purposes,Elom Corporation's operating segments

Q22: For each of the following events or

Q23: Prey Corporation created a wholly owned subsidiary,Sage

Q24: In reference to international accounting for goodwill,U.S.companies

Q26: From the standpoint of accounting theory,which of

Q27: Noncontrolling interest share was reported in the

Q30: As it is consistent with the wherewithal

Q34: Passcode Incorporated acquired 90% of Safe Systems

Q64: Logan dies with an estate worth $20