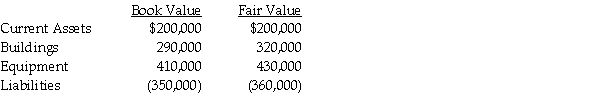

Passcode Incorporated acquired 90% of Safe Systems International for $540,000,the market value at that time.On the date of acquisition,Safe Systems showed the following balances on their ledger:

Safe Systems has determined that their buildings have a remaining life of 10 years,and their equipment has a remaining useful life of 8 years.

Safe Systems has determined that their buildings have a remaining life of 10 years,and their equipment has a remaining useful life of 8 years.

Requirement 1: Calculate the amount of goodwill that will appear on the general ledger of Passcode and Safe Systems,as well as the amount that will appear on the consolidated financial statements.

Requirement 2: Calculate the amount of amortization that will appear on the consolidated financial statements for buildings and equipment,and explain how this amortization of excess fair value is shown on the separate general ledgers of Passcode and Safe Systems.

Definitions:

Looking-glass Self

A social psychological concept that suggests individuals shape their self-concepts based on how they believe others perceive them.

Mead

An alcoholic beverage created by fermenting honey with water, sometimes with the addition of fruits, spices, grains, or hops.

Stockbroker

A professional who buys and sells stocks and other securities on behalf of clients in exchange for a fee or commission.

Overjustification Effect

A psychological phenomenon where external rewards can reduce intrinsic motivation for a task, due to the individual attributing their behavior to the reward rather than their own interest.

Q7: A parent company acquired 100% of the

Q8: The amount of income for the current

Q16: Assume Salter's net income for 2011 is

Q23: Prey Corporation created a wholly owned subsidiary,Sage

Q24: Paula's Pizzas purchased 80% of their supplier,Sarah's

Q25: At December 31,2012 year-end,Lapwing Corporation's investment in

Q28: Separate company and consolidated income statements for

Q30: If a financial instrument is classified as

Q65: During the current year,Doris received a large

Q88: A state income tax can be imposed