Use the following information to answer the question(s) below.

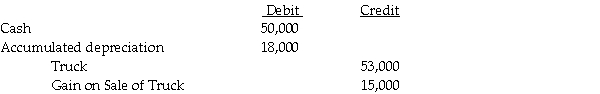

On January 1,2010,Shrimp Corporation purchased a delivery truck with an expected useful life of five years,and a salvage value of $8,000.On January 1,2012,Shrimp sold the truck to Pacet Corporation.Pacet assumed the same salvage value and remaining life of three years used by Shrimp.Straight-line depreciation is used by both companies.On January 1,2012,Shrimp recorded the following journal entry:

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

-The noncontrolling interest share for 2012 was

Definitions:

Equal Pay Act

A federal law that prohibits wage discrimination based on sex, ensuring equal pay for equal work performed by men and women.

Family and Medical Leave Act

A United States law that provides eligible employees with unpaid, job-protected leave for certain family and medical reasons.

Private Employers

Individuals or entities that operate businesses or hire workers in the private sector, as opposed to government entities.

Eligible Employees

Workers who meet certain criteria set by their employers or government regulations, qualifying them for specific benefits or rights.

Q16: A provision in the law that compels

Q23: Blue Corporation,a U.S.manufacturer,sold goods to their customer

Q25: Decoupling

Q28: Note to Instructor: This exam item is

Q31: Platts Incorporated purchased 80% of Scarab Company

Q33: Nettle Corporation is preparing its first quarterly

Q40: Pastern Industries has an 80% ownership stake

Q67: In § 212(1),the number (1) stands for

Q68: Several years ago,Logan purchased extra grazing land

Q103: As a matter of administrative convenience,the IRS