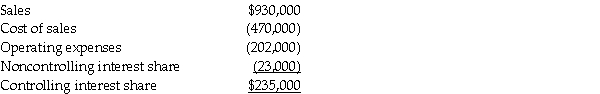

Pastern Industries has an 80% ownership stake in Sascon Incorporated.At the time of purchase,the book value of Sascon's assets and liabilities were equal to the fair value.The cost of the 80% investment was equal to 80% of the book value of Sascon's net assets.At the end of 2011,they issued the following consolidated income statement:

Shortly after the statements were issued,Pastern discovered that the 2011 intercompany sales transactions had not been properly eliminated in consolidation.In fact,Pastern had sold inventory that cost $80,000 to Sascon for $90,000,and Sascon had sold inventory that cost $50,000 to Pastern for $65,000.Half of the products from both transactions still remained in inventory at December 31,2011.

Shortly after the statements were issued,Pastern discovered that the 2011 intercompany sales transactions had not been properly eliminated in consolidation.In fact,Pastern had sold inventory that cost $80,000 to Sascon for $90,000,and Sascon had sold inventory that cost $50,000 to Pastern for $65,000.Half of the products from both transactions still remained in inventory at December 31,2011.

Required: Prepare a corrected income statement for Pastern and Subsidiary for 2011.

Definitions:

Gray-hat Hacker

An individual who may violate ethical standards or laws, but without malicious intent, often to disclose vulnerabilities.

Black-hat Hacker

An individual who violates computer security for maliciousness or personal gain, as opposed to ethical purposes.

Cyberloafing

The act of using an employer's Internet and computing resources for personal activities during work hours.

Social Engineering

A manipulation technique that exploits human error to gain private information, access, or valuables, often through deceiving individuals.

Q9: Petra Corporation paid $500,000 for 80% of

Q9: Ivan has 14,000 barrels of oil that

Q16: Which of the following is a reason

Q20: On July 1,2010,Parslow Corporation acquired a 75%

Q20: In partnership liquidations,what are safe payments?<br>A)The amounts

Q26: What is the fair value of the

Q30: What is the threshold for reporting a

Q32: Jacana Corporation paid $200,000 for a 25%

Q33: If the sale referred to above was

Q50: Income tax amnesty