Use the following information to answer the question(s) below.

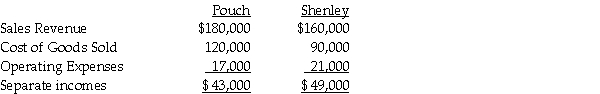

Pouch Corporation acquired an 80% interest in Shenley Corporation on January 1,2012,when the book values of Shenley's assets and liabilities were equal to their fair values.The cost of the 80% interest was equal to 80% of the book value of Shenley's net assets.During 2012,Pouch sold merchandise that cost $70,000 to Shenley for $86,000.On December 31,2012,three-fourths of the merchandise acquired from Pouch remained in Shenley's inventory.Separate incomes (investment income not included) of the two companies are as follows:

-The consolidated income statement for Pouch Corporation and subsidiary for the year ended December 31,2012 will show consolidated cost of sales of

Definitions:

Q2: Controlling interest share in consolidated net income

Q13: Noncontrolling interest share for Achille is<br>A)$18,000.<br>B)$25,200.<br>C)$36,200.<br>D)$72,000.

Q18: Sabu is a 65%-owned subsidiary of Peerless.On

Q21: Pelmer has a foreign subsidiary,Sapp Corporation of

Q24: Paula's Pizzas purchased 80% of their supplier,Sarah's

Q31: For 2011,consolidated net income will be what

Q34: Salter has a 2011 net loss of

Q38: What is the weighted-average capital for Bertram

Q80: Katrina,age 16,is claimed as a dependent by

Q125: Claude's deductions from AGI exceed the standard