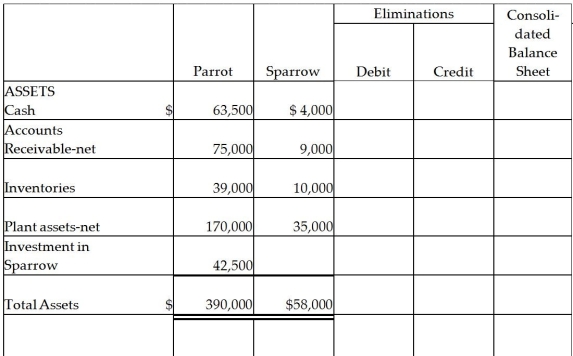

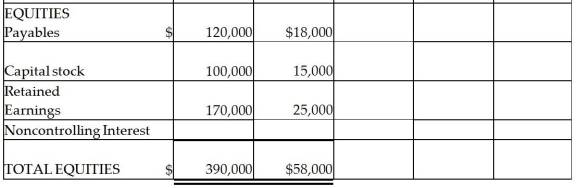

Parrot Inc.acquired an 85% interest in Sparrow Corporation on January 2,2011 for $42,500 cash when Sparrow had Capital Stock of $15,000 and Retained Earnings of $25,000.Sparrow's assets and liabilities had book values equal to their fair values except for inventory that was undervalued by $2,000.Balance sheets for Parrot and Sparrow on January 2,2011,immediately after the business combination,are presented in the first two columns of the consolidated balance sheet working papers.

Required:

Required:

Complete the consolidation balance sheet working papers for Parrot and subsidiary at January 1,2011.

Definitions:

Photosynthesis

The process by which green plants, algae, and certain bacteria transform light energy into chemical energy, using carbon dioxide and water to produce glucose and release oxygen.

Chloroplasts

Chloroplasts are organelles found in plant and algal cells that conduct photosynthesis, converting light energy into chemical energy stored in sugar molecules.

Solar Energy

Energy from the Sun that is converted into thermal or electrical energy, a renewable and sustainable source of power.

Mitochondria

Organelles found in the cytoplasm of eukaryotic cells that generate most of the cell's supply of adenosine triphosphate (ATP), used as a source of chemical energy.

Q2: On January 2,2011,Pilates Inc.paid $900,000 for all

Q16: Earth Company,Fire Incorporated,and Wind Incorporated created a

Q17: Pecan Incorporated acquired 80% of the voting

Q37: Page Corporation acquired a 60% interest in

Q38: With regard to state income taxes,explain what

Q82: A U.S.District Court is the lowest trial

Q84: A parent employs his twin daughters,age 17,in

Q100: Which of the following taxpayers may file

Q104: If an income tax return is not

Q107: A deduction for certain expenses (interest and