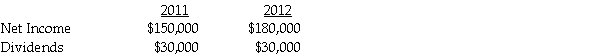

Patterson Company acquired 90% of Starr Corporation on January 1,2011 for $2,250,000.Starr had net assets at that time with a fair value of $2,500,000.At the time of the acquisition,Patterson computed the annual excess fair-value amortization to be $20,000,based on the difference between Starr's net book value and net fair value.Assume the fair value exceeds the book value,and $20,000 pertains to the whole company.Separate from any earnings from Starr,Patterson reported net income in 2011 and 2012 of $550,000 and $575,000,respectively.Starr reported the following net income and dividend payments:

Required: Calculate the following:

Required: Calculate the following:

• Investment in Starr shown on Patterson's ledger at December 31,2011 and 2012.

• Investment in Starr shown on the consolidated statements at December 31,2011 and 2012.

• Consolidated net income for 2011 and 2012.

• Noncontrolling interest balance on Patterson's ledger at December 31,2011 and 2012.

• Noncontrolling interest balance on the consolidated statements at December 31,2011 and 2012.

Definitions:

Conscientiousness

A personality trait characterized by organization, dependability, and a strong sense of duty.

Agreeableness

A personality trait characterized by warmth, friendliness, and a cooperative attitude towards others.

Internal Locus

A belief that one has control over one's life and outcomes through one's own efforts, abilities, and actions.

Volleyball

A team sport in which two teams of six players are separated by a net, with each team trying to score points by grounding a ball on the other team's court.

Q2: Controlling interest share in consolidated net income

Q11: The following citation is correct: Larry G.Mitchell,131

Q17: Plower Corporation acquired all of the outstanding

Q18: Edgar had the following transactions for 2015:

Q28: Peregrine Corporation acquired an 80% interest in

Q31: Plenny Corporation sold equipment to its 90%-owned

Q36: What is the fair value of the

Q70: Failure to file penalty

Q90: A tax credit for amounts spent to

Q119: For the current year,David has wages of