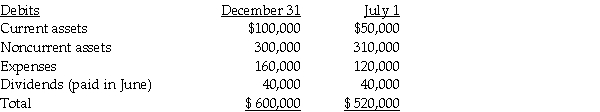

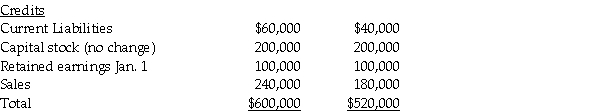

Wader's Corporation paid $120,000 for a 25% interest in Shell Company on July 1,2010.No information is available on the fair value of Shell's assets and liabilities.Assume the equity method.Shell's trial balances at July 1,2010 and December 31,2010 were as follows:

Required:

Required:

1.What is Wader's investment income from Shell for the year ending December 31,2010?

2.Calculate Wader's investment in Shell at year end December 31,2010.

Definitions:

Conversion Price

The predetermined price at which convertible security, such as a convertible bond or preferred stock, can be converted into a specified amount of common stock.

Coupon

The annual interest rate paid on a bond, expressed as a percentage of the face value.

Convertible Bond

A category of bond which allows conversion into a specific quantity of the issuer's equity at designated times throughout its lifespan, often at the choice of the person holding the bond.

Conversion Price

The predetermined price at which a convertible security, like a convertible bond or preferred share, can be converted into common shares of the issuing company.

Q2: Pike Corporation paid $100,000 for a 10%

Q7: Peel Corporation acquired a 80% interest in

Q15: Samantha's Sporting Goods had net assets consisting

Q17: Pecan Incorporated acquired 80% of the voting

Q25: At December 31,2012 year-end,Lapwing Corporation's investment in

Q27: Pretax operating incomes of Pang Corporation and

Q38: Pascal Corporation paid $225,000 for a 70%

Q38: A parent company regularly sells merchandise to

Q54: To lessen,or eliminate,the effect of multiple taxation,a

Q101: Which,if any,of the following taxes are proportional