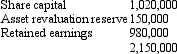

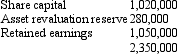

Dolly Ltd acquired a 60 per cent interest in Vardon Ltd on 1 July 2002 for a cash consideration of $1,300,000.At that date fair value of the net assets of Vardon Ltd were represented by:  On 1 July 2004 Dolly Ltd purchased the final 40 per cent of the issued capital of Vardon Ltd for cash consideration of $950,000.At this date the fair value of the net assets of Vardon Ltd were represented by:

On 1 July 2004 Dolly Ltd purchased the final 40 per cent of the issued capital of Vardon Ltd for cash consideration of $950,000.At this date the fair value of the net assets of Vardon Ltd were represented by: Impairment of goodwill was assessed at $3,000; of which $2,000 related to the year ended 30 June 2005.There were no intragroup transactions.What are the consolidation entries to eliminate the investment in the subsidiary and amortise goodwill for the period ended 30 June 2006?

Impairment of goodwill was assessed at $3,000; of which $2,000 related to the year ended 30 June 2005.There were no intragroup transactions.What are the consolidation entries to eliminate the investment in the subsidiary and amortise goodwill for the period ended 30 June 2006?

Definitions:

Imperiled Person

An individual who is in a situation of great risk, danger, or jeopardy, often requiring urgent assistance or intervention.

Affirmative Action

A policy favoring those who tend to suffer from discrimination, especially in relation to employment or education.

Negligent Conduct

Actions or behaviors that fall below the legally established standard of care, leading to harm or damage to another person.

Legally Protected Interest

An interest recognized and protected by law, such as property rights or personal rights, safeguarding individuals or entities.

Q16: The following consolidation adjusting journal entries appeared

Q27: To classify an arrangement as a hedge,and

Q32: The matching concept leads accountants to select

Q36: AASB 128 requires that where an investor

Q37: A former loophole (now closed)that existed under

Q38: Aus Co Ltd has a foreign operation

Q39: Hedges cannot be designated and/or documented on

Q42: Chester Company began Year 2 with a

Q50: The types of reports that a superannuation

Q52: Which of the following consolidation concepts are