Figure 2-10

Figure 2-10

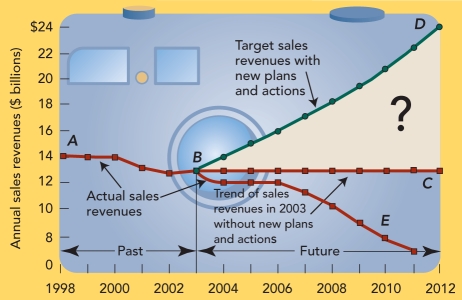

-question mark (?) represented by the wedge DBC in Figure 2-10 above is the __________.

Definitions:

Average Tax Rate

The average tax rate is the percentage of total income that an individual or corporation pays in taxes, calculated by dividing total tax paid by total income.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, reflecting the rate applied to each additional dollar of income.

Social Security Tax

A payroll tax collected to fund the Social Security program, which provides benefits to retirees, disabled individuals, and survivors.

Taxable Income

The portion of income subject to tax by the government after all deductions and exemptions.

Q2: Ben & Jerry's sold a line of

Q6: Cho Co. ,a public Canadian corporation has

Q18: consumers are committed to brands with a

Q27: Liverpool Company operates retail stores in Canada

Q51: 2010,Fortune magazine named Trader Joe's "America's hottest

Q83: 1988,the Trademark Law Revision Act resulted in

Q127: primary purpose of a doppelganger is to<br>A)

Q208: growing trend to "Buy American" has caused

Q311: _ element of the marketing mix includes

Q326: Procter & Gamble is a consumer packaged